Capital markets are an inherently queer place. Securities produce financial returns by manifesting intrinsic value.

Or as some might say, “living their best life.”

As America’s leading loft-based finance transsexual, the inherent gayness of creating shareholder returns this way has long been old news to me. But while Ashby and I were discussing queer issues on this latest episode of the Free Money Podcast, he reminded me that some have been working to exclude companies which support (among other things) the “LGBT Lifestyle” from their investment portfolios.

The Inspire Global Hope ETF (BLES) is perhaps the largest such fund. And with roughly $150MM in assets under management, it’s no behemoth. But with a slightly bigger base of assets, it might form the basis for a poetically beautiful pairs trade. That’s where investors buy one security and bet against another, hoping to profit from the difference between their performance.

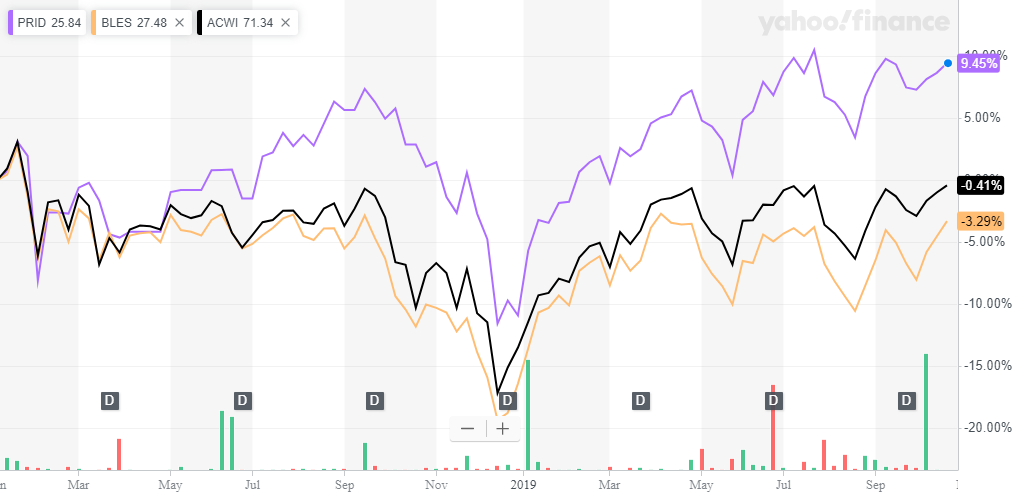

The chart below shows:

The aforementioned BLES ETF in khaki (the official heterosexual color).

The LGBT Employment Equality ETF (PRID) in lavender (the official gay color).

The MSCI ACWI index in black (the official color of benchmarks).

An investor who bought PRID and bet against BLES at the beginning of 2018 would have captured a 12.7% performance spread before fees and transaction costs. In other words, if this fund gets a little bigger, one could build a business around betting against it.

Here’s hoping.

Have a listen to the podcast for some further discussion about queer issues, coming out, and (as always) pensions. And for fun, here’s a picture I took right before coming out two years ago and a selfie I took yesterday. You might say I’ve womanifested some intrinsic value in the meantime.

How to Hedge against the Heterosexual Ideology