This is Free Money, a newsletter and a podcast that helps long-term investors with social missions make good decisions with their money.

There is “a time bomb waiting to go off” in some American states.

That’s according to Ben Oppenheim, PhD, a computational epidemiologist at Metabiota and our guest on this episode of Free Money. We spoke on the first of May, one day after the United States endured its highest death toll so far in this pandemic. And the outlook isn’t great. The places with growing case counts “have older populations, a lot of preexisting conditions, worse health systems, and more structural barriers to people getting the kind of care they need.”

He stressed that “my worry is not wave one [of infections], but wave two.” That’s because “we can be successful in the first round, but until we’ve got a vaccine, really good therapeutics, or herd immunity, this thing could come back in a hurry. We’ve seen that in some countries that were initially successful.”

These events — often thought of as the public health equivalent of a ‘hundred year flood’ — are vastly more likely to occur than people generally think. In fact, this is the third coronavirus outbreak this century. SARS struck in 2003, followed by MERS in 2012.

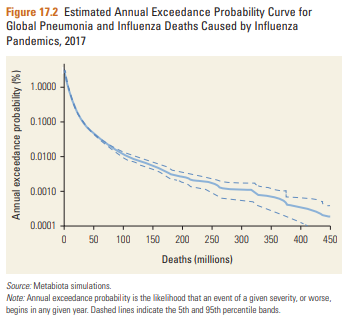

So it’s not like this wasn’t on our radar. The chart below comes from a textbook chapter Ben contributed to entitled Pandemics: Risks, Impacts, and Mitigation. It shows estimates of the annual probability that the death toll from an influenza pandemic will exceed a given quantity.

Note that the x-axis is denominated in millions, which means Metabiota simulations show a roughly 1% annual chance of more than one million dead.

At one point in our interview, Ben muses about our collective priorities before the pandemic and wonders aloud: “What the hell were we doing?”

And that’s where we want you to concentrate. This is likely to be the crisis that makes ESG-aware investment processes not just commercially viable, but highly relevant. The Wall Street Journal reported over the weekend that ESG funds protected investors from some losses during the recent selloff, likely because they held fewer investments in energy companies.

Long term investors, take notice. This is the second historically aberrant natural disaster we’ve endured recently. When we recorded our last episode shortly before New Year’s Eve, much of the west coast had lost power due to widespread wildfires. Integrating ESG processes won’t predict these events, but they will prepare portfolios with an awareness of future risks and promote better corporate citizenship.

Ben reminds us that “Pandemics are not a health system event…when they hit, they engulf the whole of society.” So the question for you is: can you find your part in creating a better whole?

We also discussed all of these questions in this week’s Dear Ashby segment:

If states do wind up declaring bankruptcy due to the coronavirus, what would happen to state pensions?

What have you started doing during lockdown that you plan to continue when life returns to normal?

Because of the pandemic, lots of Americans are making more in unemployment benefits than they typically make in income. How should we be thinking about that?

The Next Wave Could Be a Doozy